Best Way to Buy and Sell House at Same Time

Table of contents

- Selling your firm before buying a new i

- Pros and cons

- Tips if you're selling commencement

- Buying a house earlier selling

- Pros and cons

- Tips if you're buying first

- Buying and selling at the aforementioned time

- Which is the right move for yous?

If you already own a home, the premise of buying another house can be pretty daunting.

Practice you sell your home commencement and live in limbo while looking for another, or do you buy now and pes the bill for two mortgage payments until yous're able to sell? Tin you fourth dimension information technology perfectly and do both at one time?

The truth is you have several options when selling a dwelling and buying another. The best pick really depends on your personal situation, your holding (and the market it's located in), and your budget.

Let's look at all three options in-depth.

Selling your house before buying a new one

Many people choose to sell their existing firm first. This allows yous to have the sale proceeds in hand when searching for that dream home, and it significantly reduces the financial stress of the situation. There's no managing two mortgage payments or dealing with closing costs while maintaining two houses. It'southward simple, straightforward, and easy to upkeep for.

→ Haven't heard of Opendoor? Learn how we make selling your home easier.

The biggest downside to this approach is that it leaves yous homeless, for lack of a better word. Afterward you sell your home and while you hunt for another, you lot're left in limbo, living in your parent'south basement or on a friend'due south living room couch. If you have a family, pets, or lots of holding, that can be a pretty inconvenient manner to live — especially without an end in sight.

Yous also have to move twice. First, to your temporary housing, and so once more, one time yous detect your new property. That means twice the hassle and twice the costs.

Finally, information technology can make you lot feel rushed or under the gun. With your old house sold and no permanent place to live, the stress could push button you toward purchasing a home you lot're non quite in beloved with or ready for.

Pros and cons

| Pros | Cons |

| Less financial stress | Leaves you living in limbo |

| More than security | Requires two moves |

| Frees up greenbacks for your new home buy | Doubles your moving costs |

| Avoids two mortgage payments | May make you feel rushed to purchase your new holding |

| May exist easier to qualify for a new mortgage | May require added storage costs |

Tips if you lot're selling outset

In the effect you lot do opt to sell your home first, there are a few steps you tin have to ensure the procedure goes as smoothly equally possible.

Y'all can:

- Arrange temporary housing: Earlier you list your home, make sure y'all accept a temporary identify to alive once the belongings sells. This could mean living with a friend or family member, or it might mean renting a hotel room for a few months while you look for a new house. Whichever option yous choose, accept a plan (and financial resources) in place to make it happen.

- Know what you're looking for in a new house: Go ahead and showtime narrowing downwards your list of must-haves, and inquiry potential neighborhoods and communities. As presently every bit you've accepted an offer on your existing firm, y'all should start hunting for your new property right away to minimize your time in limbo.

- Be ready to purchase: Accept a mortgage lender in mind and become preapproved for your loan once you choose one. You should as well set your budget, preferences, and timeline, then you tin can start viewing relevant backdrop as soon every bit your old house sells.

- Consider a lease-back: If the buyer of your onetime firm isn't on a tight timeline, you may exist able to negotiate a lease-dorsum. This allows you to "hire" the property from the new owner for a certain amount of time while you lot look for a new home. You may need to make payments to the buyer in order to exercise this, or it might hateful reducing the sales price or other concessions.

You should likewise accommodate for some sort of storage solution, especially if y'all'll be staying in a hotel or with friends. Portable storage pods are an affordable, easy solution, and they'll make your final move easier, too.

→ See our guide to selling your home fast

Buying a firm before selling

In that location are a lot of advantages to buying your new habitation first, before selling your old one. Primarily, it makes the motility easier. You're able to take your time, move your belongings to the new place on any schedule you like, and avert living in limbo while yous wait for that onetime house to sell. It's also a practiced choice if you're on a tight timeline. If y'all know you need to be in a new city for a new job by a sure date, buying outset tin can help ensure you've got a place to live past your set-in-stone deadline.

On the fiscal side, information technology'southward another story, though. Ownership your new home kickoff takes serious financial resources. Not only will you lot however have your existing mortgage payment, but you'll have a new one, plus closing costs, your down payment, moving expenses, and upkeep and maintenance on both properties. It can be a lot to handle, especially if you're on a tight budget or limited income.

Buying first may also brand getting a mortgage harder. Because y'all even so have the existing mortgage debt to your proper noun, your debt-to-income ratio could be much college. That could mean a lower bachelor loan residual for your new buy, higher interest rates, or fifty-fifty not qualifying for a loan at all. Co-ordinate to Quicken Loans, in order to qualify for near mortgages, borrowers should take a debt-to-income ratio no greater than 43%.

Pros and cons

| Pros | Cons |

| An easier move | Ii mortgage payments |

| More control over your timeline | Higher debt-to-income ratio |

| No living in limbo or with friends and family | More than financial stress |

| A more relaxed home ownership process | Difficulty qualifying for a mortgage |

| Potentially a higher mortgage rate and lower loan balance | |

| Difficulty coming up with down payment |

Tips if you lot're buying first

If you do decide to buy your new business firm first, in that location are a few ways you lot can make the process easier — both on your household and your finances.

Yous can:

- Rent out your former property: One time you've moved into your new place, consider leasing out your old house to a temporary tenant. You lot could also hire information technology on Airbnb, VRBO or another brusk-term rental platform. This will let you to generate income to maintain the habitation and pay its mortgage while y'all wait for a permanent buyer.

- Consider a contingency clause: When submitting an offer on a new house, you can include what'south called a sale contingency. This states that your offer is awaiting the sale of your current home. If your home doesn't sell in the specified timeframe, you can dorsum out of the bargain unscathed. Though non every seller will agree to these terms, only if the market is slow there's a chance they'll consider it.

- Consider a domicile disinterestedness loan or bridge loan: If you have disinterestedness in your current home, you could free upwards cash to comprehend your down payment, closing costs, and boosted expenses while maintaining both properties. A bridge loan makes information technology possible to finance a new house before selling your electric current home. Both options may accept high interest rates, so take a closer look with a financial advisor before going these routes.

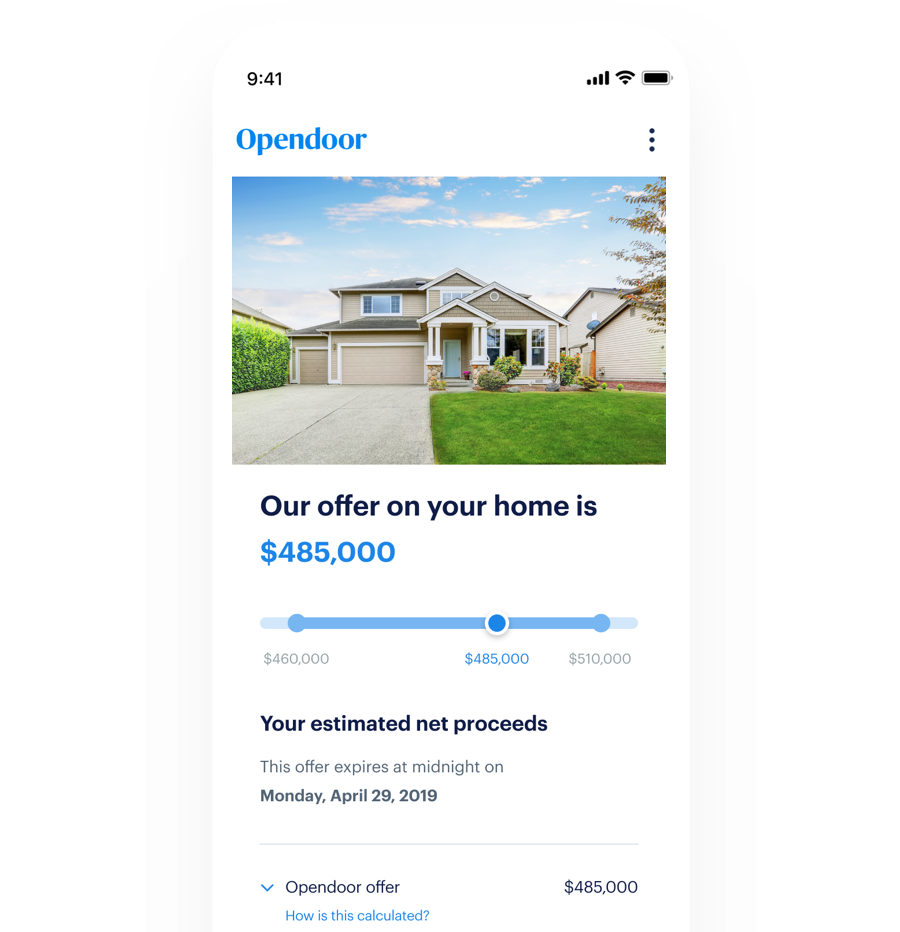

- Sell your firm to an iBuyer: An iBuyer similar Opendoor can buy your old domicile in as fiddling as 14 days without all the hassle and headache of the open market. Simply provide some details about the property, and if it's eligible, Opendoor volition make a cash offer to buy the firm outright — no showings or marketing necessary. You can even choose your ain closing engagement.

At the cease of the day, buying your new home first is simply 1 of three options you can cull from. Make sure yous consider all your choices earlier deciding which route is all-time for your financial goals.

Ownership and selling at the same time

Finally, you have a 3rd choice: you lot can buy and sell at the aforementioned time. Information technology might sound complicated, but with the right resources in place, it can actually be quite easy.

Traditionally, selling and buying at the same time has been difficult. You had to time your two transactions perfectly, negotiating with the buyer for a subsequently closing appointment and pushing your lender to work fast to prevent whatever lag fourth dimension between sales.

Fortunately, iBuyers have made this process much simpler. With programs like Opendoor'south trade-in offering, you lot tin can:

- Get a gratuitous greenbacks offer in just 24 hours

- Brand an offer on an existing Opendoor home (and, in select cities, an offer on any home on the market)

- Schedule your closing dates for both transactions simultaneously

There'due south even an option if you want to sell your existing home and build a new construction property simultaneously. Both options let you choose your closing and move-in dates, every bit well as avoid selling hassles like showings, staging, open houses, and more than.

Which is the right move for you lot?

The all-time selection for you depends on a lot of factors. Y'all'll desire to call back about your timeline, your financial situation, your local housing market, and more than.

To aid gauge the correct route for your home sale, enquire yourself these questions:

- What tin can I afford? Can y'all afford to manage two mortgage payments at the same fourth dimension? Tin can you lot handle maintaining multiple properties, besides as the taxes and expenses that come up with them? Know your budget, as well as what your expected costs might be in all 3 scenarios.

- How competitive is the market? If you're in a hot, in-need market, it might be harder to notice a home quickly. Yous may desire to sell start to maximize your profits, and then delay your purchase until the market place cools.

- Are at that place iBuyers available in my area? iBuyers are quickly expanding to markets across the state, only they're not present everywhere just yet. Meet if we're in your neighborhood.

- How quickly exercise I demand to move? Are y'all working on a prepare timeline, or do you take more flexibility? If you've got a deadline, you may need to buy first in order to ensure you meet it.

- What condition is my habitation in? Is it motion-in ready, or does it demand lots of repairs and work? If it's the latter, that will mean more expenses, a lower sales toll and, near likely, a longer time on the market. Yous might consider selling to an iBuyer who volition handle the dirty work on your behalf.

The bottom line is there's no wrong or right choice when information technology comes to selling your business firm and buying some other. Take time to consider the full picture, and know the pros, cons, and costs that come with each option.

By Aly Yale

Unlock an offer on your dwelling

- Become a complimentary, no-obligation offer in 24 hours.

- Skip the hassle of listings, showings, and repairs.

- Close on your own timeline.

Source: https://www.opendoor.com/w/guides/how-to-sell-and-buy-a-house-at-the-same-time

0 Response to "Best Way to Buy and Sell House at Same Time"

Post a Comment